Key Points

- Track 20 Core MSP Metrics: Measure key MSP KPIs across profitability, efficiency, customer satisfaction, and growth to assess overall business performance.

- Focus on Profitability Drivers: Monitor EBITDA margin, revenue growth, and percent of revenue from MRR to evaluate financial health and recurring income stability.

- Prioritize Retention & Value: Improve customer retention, employee retention, and customer lifetime value (LTV) while keeping CAC low for sustainable ROI.

- Optimize Operations & Service Delivery: Use metrics like technician utilization, SLA adherence, average response time, and resolution time to boost productivity and client satisfaction.

- Leverage Data for Growth: Regularly analyze these MSP metrics—using tools like the MSP pricing calculator—to drive profitability, scalability, and investor confidence.

When you’re operating heads-down on your business, it can be easy to get caught up in the grind and lose sight of whether you’re focusing on the top things that truly matter. Tracking the right metrics can help keep you focused and alert you to what needs calibrating and how urgently. There’s no lack of possible metrics and KPIs (Brightgauge shares 70 here), but to help you stay focused, let’s step back and review the top 20 MSP business metrics.

Profitability metrics

High-level financial health indicators and valuation drivers

Let’s start by looking at what investors and financial advisors focus on when they valuate MSPs. To determine if your business is healthy and performing well, you should first examine at your profitability metrics.

1) EBITDA margin

Your EBITDA or Earnings Before Interests, Taxes, Depreciation, and Amortization measures your MSP’s revenue before being subtracted from other costs. This metric is vital because revenue alone doesn’t measure the value of an MSP; profitability is what really matters.

The EBITDA margin is calculated by dividing the EBITDA by your total revenue, and the target should be about 15-20% of your gross annual revenue.

EBITDA margin = EBITDA / total revenue

2) Revenue growth rate

The revenue growth rate is a metric that indicates the increase in revenue generated by your company. A high revenue growth rate indicates that you have more money to invest in your organization as a whole and that your business is on an upward trajectory.

Calculate your revenue growth rate by subtracting the previous year’s revenue from the current year’s revenue and dividing that by the previous year’s revenue. The outcome should be a percentage, aiming for at least a 10% year-over-year increase

Revenue growth rate = (Revenue current year – Revenue previous year) / Revenue previous year

3) Percent of revenue from MRR

Your monthly recurring revenue (MRR) is the revenue that’s generated by your business due to recurring payments. For an MSP, this is typically achieved through contracts and managed service agreements. Investors love that because it lowers risk and makes it more predictable. Businesses with higher MRR are worth LOT more because their revenue will continue in the future.

You can calculate your percent of revenue from MRR by dividing the MRR revenue by the total revenue. Your target should be 80% or more.

Percent of revenue from MRR = (MMR / Total Revenue) * 100

4) Customer retention rate

Successful businesses don’t just acquire new customers; they also retain existing ones. It’s always cheaper to keep your current customers than acquire new ones, and investors want to see that you have high customer retention. An even loftier goal would be to achieve negative churn, which occurs when the lost revenue from churn is less than the revenue from expansions or upsells from your current customers.

Calculate customer retention by subtracting the number of customers at the end of the year from the number of customers acquired, then dividing it by the total customers from the previous year.

CRR = (CustomersEnd of Year – CustomerAcquired) / CustomersPrevious Year

5) Client concentration

Your client concentration should be spread out and diversified so that your entire business doesn’t rest on the fate of one or a few customers. It’s important for you to work yourself out of “too-many-eggs-in-one-basket” scenarios, where losing any one customer (or vertical) would be fatal to your business.

This metric is calculated by dividing the revenue earned from a customer(s) in a year by the total yearly revenue. No single customer should account for more than 25% of your revenue, and no five customers should account for more than 50% of your revenue.

Client concentration = RevenueCustomer/Total Revenue

6) Employee retention

Employee retention greatly affects business productivity and growth. Consequently, investors want to see that you’re not losing people in your business internally. Monitoring your employee retention and churn rate can help you identify areas for improvement within your company.

First, determine your average number of employees by adding the number of active employees at the beginning of a period and the number of active employees at the end of a period, and then divide

2. After that, you can calculate the employee churn rate by dividing the number of employees who left during a period by the average number of employees and multiplying by 100. Your target should be complete employee retention or 0% churn.

Average no. of Employees = (Active Employees + Active Employees) / 2

Employee Churn Rate = (Employees who Left / Average no. of Employees) * 100

Identifying your most profitable (and problem) clients

7) Customer lifetime value (LTV)

Customer lifetime value (CLTV) is the total amount a customer generates for you over their lifetime. You can also group and break your customers up into cohorts or classes to determine which groups generate the most lifetime value for your business. In addition to helping you identify your best clients, LTV can help you determine how much you can afford to spend on sales and marketing to maintain a healthy CAC ratio and ROI.

Customer lifetime value is calculated by subtracting the cost of acquisition from the total revenue generated by a customer over their lifetime.

Customer Lifetime Value = Cost of acquisition – Total customer Revenue

8) Cost & revenue per end user supported

The cost and revenue per end user measure how much you make per seat. This illustrates how profitable a certain agreement can be when the cost is based on the number of end users supported. Comparing this metric with the cost and revenue per endpoint supported allows you to determine whether or not you need to raise your prices.

Our MSP pricing calculator enables you to automatically calculate both the cost and revenue per end-user.

9) Cost & revenue per endpoint supported

The cost and revenue per endpoint tracked show track how much you earn per device. Depending on the client you are providing services for, there could be situations where you’d rather incur a certain cost per endpoint.

Again, our MSP pricing calculator can help you calculate this metric to help you determine profitability.

Note: It’s worth tracking both users and endpoints to identify any anomalies.

Ensuring you’re operating efficiently and you have the correct number of staff

10) Technician hourly cost

Labor is a big part of the total costs for an MSP, so you’ll want to know how much your technicians are costing you per hour.

If technicians are paid hourly, then the hourly cost is equivalent to their hourly rate. If they are salaried, calculate the number of hours they work per week and divide their annual pay by 52. Then, divide their weekly pay by the number of hours worked per week to determine the technician’s hourly cost.

Weekly Pay = Annual Pay / 52

Technician Hourly Cost = Weekly Pay / No. of Hours Per Week

11) Utilization rate

Utilization is a metric used to help you determine if you have the right-sized staff. It is a measurement of the productivity of your employees that shows how efficiently they’re working with the resources they’ve been provided.

The utilization rate is calculated by dividing the number of hours spent on client work by the total hours worked.

Utilization rate = Hours spent on client / Total Hours Worked

Sales and marketing metrics

12) Customer acquisition cost (CAC)

Customer acquisition cost (CAC) refers to the amount of money spent to acquire a new client. This includes the sales and marketing expenses needed to convert a lead into a customer. You’ll want to ensure that you’re not overspending to gain new business.

CAC is calculated by adding your sales and marketing costs and dividing that sum by the number of customers acquired. It should be no more than one-third of your LTV, meaning you should be earning at least three times what you pay to acquire any given client.

CAC = (Sales Cost + Marketing Cost) / No. of Customers Acquired

13) Qualified lead velocity rate

Your qualified lead velocity rate is the growth percentage of qualified leads that are generated month over month. This metric measures your pipeline development in real time and serves as a good indicator of sales revenue.

You can calculate your qualified lead velocity rate by subtracting the qualified leads from last month from your qualified leads this month and dividing that result by the qualified leads from the previous month. Multiply it by 100 to get the lead velocity rate percentage.

Qualified Lead Velocity Rate = (Qualified LeadsCurrent Month – Qualified LeadsPrevious Month) / Qualified LeadsPrevious Month

14) Cost per lead

Cost per lead is the amount of money required to generate a new lead for your business. It is a very simple metric, but it is worth tracking because it helps you determine the effectiveness of your marketing and lead generation efforts

Calculate cost per lead by dividing the total amount spent on marketing efforts for lead generation by the total number of new leads.

Cost per lead = Marketing costs / Number of new leads

15) Conversion rates

There will be multiple steps in your sales funnel. It’s important to measure conversion rates between each one. Conversion rates enable you to identify potential issues in the pipeline.

Here’s an example of the steps in a sales funnel:

- Lead → Qualified lead

- Qualified lead → Opportunity

- Opportunity → Closed deal

The conversion rate is calculated by dividing your total sales by the number of leads and then multiplying the result by 100.

Conversion rate = (Total sales / No. of leads) * 100

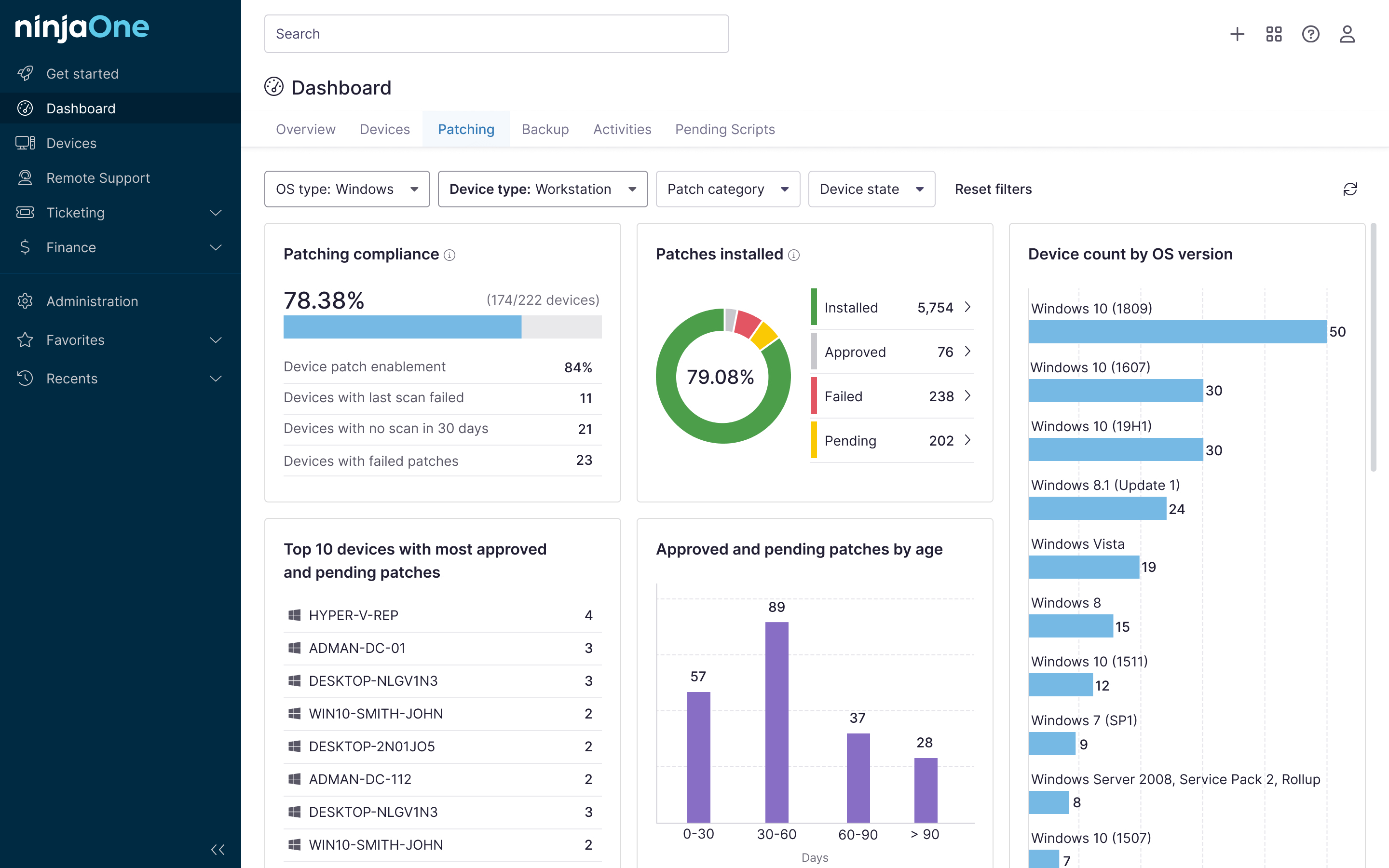

Service metrics

16) SLA adherence

Service level agreement (SLA) adherence measures the rate of customer incidents that are resolved within the agreed-upon SLA parameters. This demonstrates your ability to deliver services within the contract parameters and ensures accountability.

Divide the total number of resolved incidents that are within SLA parameters by the total number of incidents to calculate SLA adherence.

SLA adherence = No. of resolved incidents / No. of incidents

17) Tickets opened vs. tickets closed

This is a simple comparison between two key metrics. Any time a ticket is opened, an issue needs to be resolved or a service needs to be provided. As an MSP, your goal is to close more tickets than your clients open in a given period, resulting in a smaller backlog of service requests.

Simply count the number of open tickets and closed tickets in a given period, then compare the two numbers. Aim to have more closed than open tickets.

18) Average time to response

The average time to response measures how quickly you begin working on a request after receiving a ticket. Customers want to see a short response time so they know you’re reliable and that you’re actively working to resolve their issue.

Measure the length of time it takes for your technicians to respond after initially receiving a ticket. Calculate the average by adding all these measurements and dividing by the number of responses.

Average response time = Total response time / No. of responses

19) Average time to resolution

The average time to resolution measures how long it takes to resolve a ticket. The faster you resolve a ticket, the happier your end users and customers will be.

Track the length of time between when your technicians first receive a ticket and the resolution of the issue. Calculate the average by adding all resolution times together and dividing by the number of resolved tickets.

Average resolution time = Total resolution time / No. of resolved tickets

20) CSAT

Your customer satisfaction score (CSAT) is an indicator of how satisfied your customers are. It’s essential to measure this so you can determine whether your clients are genuinely happy with your services. Clients rate the services they received on a scale of 1 (very unsatisfied) to 5 (very satisfied).

CSAT is calculated by adding the total number of satisfied customers (rated you 4 or 5) and then dividing that total by the total number of survey responses.

For a visual demonstration of these performance and service metrics in action, please watch this brief video: ‘20 Critical Business Metrics for MSPs’.

The importance of tracking MSP business metrics

Running an MSP business is no small task, but tracking key business metrics provides insight into how your business is actually performing. There’s plenty of other data you can observe; these are just the top twenty metrics you should be monitoring.

Tracking these MSP business metrics will help you to objectively assess at your business operations and make effective changes that can improve your company.

Check out our MSP pricing calculator to help you calculate many of these metrics, their costs, and total revenue for your MSP business.