Key Points: How to value your MSP in 2025

- Strong EBITDA (15%+) is essential. Most buyers prefer MSPs with $500k in EBITDA and clean financials.

- Recurring revenue drives valuation. Aim for 70%+ of income from managed service agreements.

- Low churn builds trust. Top-performing MSPs retain 90%+ of clients annually.

- Diversification reduces risk. Avoid relying on a few clients or a single vertical.

- Documentation and standardization matter. Investors prefer MSPs with SOPs and mainstream tech stacks.

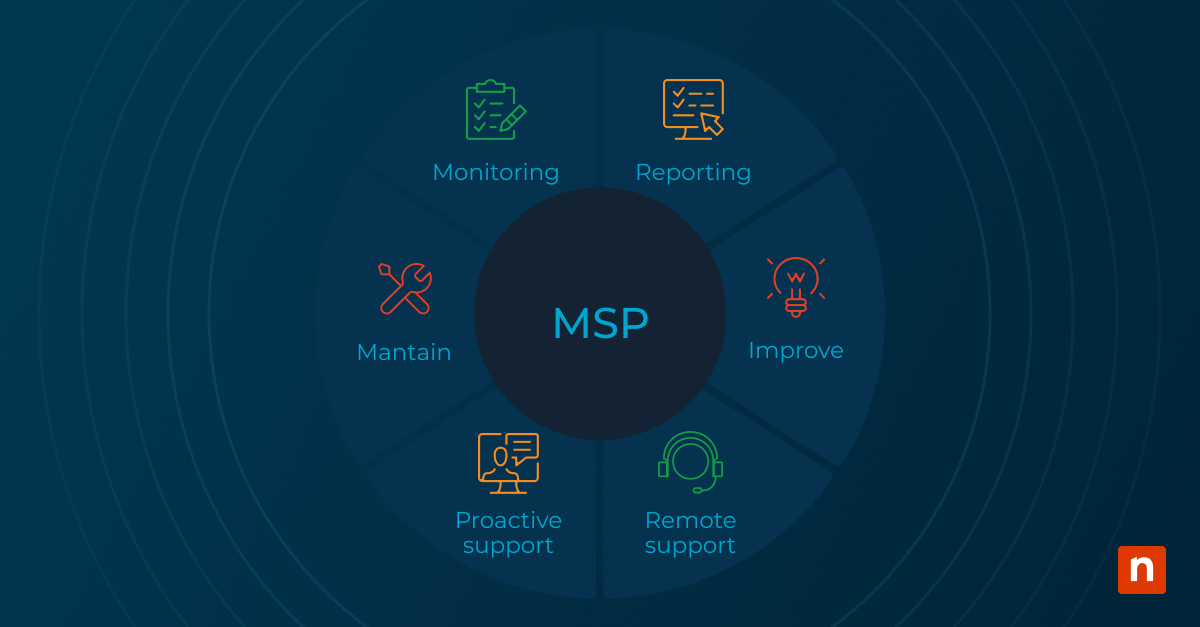

This guide helps you understand MSP valuation and how to value your MSP in 2025. Before you market your MSP for sale, it’s critical to understand that there are typically three main types of buyers, each with their own valuation lens:

- A strategic MSP buyer or a larger competitor: This type of buyer usually seeks to cement their position as an industry leader in their region, but their dealmaking might be slower as it is not their primary expertise. Even so, they may offer favorable terms for long-term integration.

- Private equity or capital funds: This type of buyer typically moves quickly and can be more aggressive in acquisitions, especially if your MSP fits into a wider roll-up strategy. These investors are typically focused on scalable businesses with strong Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) and low churn.

- The independent entrepreneur or a “search fund”: This type of investor may be the most diverse in terms of their position. In some cases, they are raising capital while looking to close a deal or adding an MSP to complete their business portfolio. Usually, these types of investors are newer to the space, but are agile and acquisition-ready.

Each buyer type values operational maturity and predictable revenue, but they also prioritize ease of integration and low cybersecurity risk.

What influences MSP valuation in 2025?

There is no one-size-fits-all valuation formula for MSPs. However, there are several recurring themes that investors consistently prioritize. These factors affect how desirable your MSP appears, how risky it may feel to be, and how easy it would be to scale post-acquisition.

Here’s a simplified breakdown:

| Factor | Impact on Valuation | Why it matters |

| Healthy EBITDA margin | ⬆️Increases | Shows operational efficiency and profitability; critical for investor ROI. |

| High MRR and predictable revenue | ⬆️ Increases | Recurring income is stable, forecastable, and highly valued by the acquirer. |

| High client churn | ⬇️Decreases | Indicates poor retention or service dissatisfaction; raises buyer risk. |

| Steady, strategic growth | ⬆️Increases | Demonstrates long-term viability and disciplined business development. |

| Narrow geography or single vertical | ⬇️Decreases | Limits scalability and increases exposure to regional/sector-specific risks. |

| Heavy reliance on a few clients | ⬇️Decreases | Revenue concentration introduces fragility; the loss of one client can significantly impact cash flow. |

| Strong documentation and SOPs | ⬆️Increases | Makes the business easier to run, transition, and scale. |

| Custom or fragmented tech stake | ⬇️Decreases | Increases post-acquisition overhead; hard to integrate into the buyer’s systems. |

| Poor online reputation or culture issues | ⬇️Decreases | Suggests potential staff retention issues post-sale and weak leadership. |

| Cooperative, likeable leadership | ⬆️Increases | Smooth communication and trust-building increase deal confidence and terms. |

Let’s break each factor down in the next section.

Showcase your value by ensuring MSP capabilities can meet client expectations.

MSP valuation criteria: 10 things investors do and don’t want to see

1) ✅ They DO want to see a healthy EBITDA margin

EBITDA (earnings before interest, taxes, depreciation, and amortization) or operating profit is essential to getting on any potential investor’s radar. Typically, investors like to see at least $1M in annual EBITDA. We’ve seen other MSP purchasing organizations like MSP Corp and Evergreen look at MSPs with at least $300K or $500K in annual EBITDA, respectively.

Why it matters:

EBITDA remains one of the (if not, the) go-to metrics for most investors. It helps buyers evaluate your MSP’s ability to generate profit from core operations without financial distortions.

What investors want to see:

- Consistent year-over-year profitability.

- Clean financials with at least 15%+ EBITDA margins

- Clean books with minimal one-time adjustments.

💡 Don’t worry if you’re below $1M EBITDA. Strong fundamentals like high MRR and excellent documentation can still attract serious buyers.

2) ✅ They DO want to see the majority of your revenue be MRR

MRR or monthly recurring revenue is a metric that most MSP operators should already be very familiar with. To score a great valuation with potential investors, they want to see recurring and predictable revenue tied directly to managed service agreements.

Why it matters:

Buyers look for predictable, contract-driven revenue, especially if it renews automatically.

What investors want to see:

- 70% or more of total revenue from recurring managed services

- Clean contract terms, low variance billing

- Limited reliance on project or break/fix income.

💡 The more recurring and low-touch your revenue model, the easier it is to justify a premium multiple.

3) ❌ They DON’T want to see more than 10% of your customers churning

A potential investor wants to make sure that they’re buying a business with healthy contracts and customers that won’t depart as soon as there’s a change in ownership. Retaining around 85% of your current clients and 90% of your revenue year over year is a great data point to display when looking to score a top-notch valuation. According to a Gitnux report, the average churn rate is around 5% annually.

Why it matters:

A high churn rate undermines valuation. This signals to investors that, for one reason or another, customers are not satisfied with your service.

What investors want to see:

- 80-90% client retention annually.

- Clear success metrics for accounts.

- A low-risk ownership transition plan.

💡 Retention equals trust. Strong client stickiness shows that your MSP delivers real value, even under new leadership.

4) ✅ They DO want to see steady growth

Investors aren’t looking to get on the rocketship of the next explosive growth startup when acquiring an MSP, but they are looking for steady single-digit growth year over year.

Why it matters:

Investors are drawn to MSPs that show consistent and reliable growth over time. While rapid expansion may sound impressive, it may raise concerns about operational stability or scalability.

What investors want to see:

- Gradual revenue and client base expansion.

- Realistic growth goals supported by strong delivery capabilities.

- Clear expansion roadmap or niche penetration.

💡 Most acquirers, especially those in private equity, are looking for MSPs with a clear track record of year-over-year improvement, not risky spikes.

5) ❌ They DON’T want to see limiting geographies or verticals

Location, location, location… The age-old adage holds true with potential MSP investors as they are looking to acquire a business in a growing market with multi verticals to service. One thing that can hurt a valuation is a location that limits future expansion or lacks vertical diversification.

Why it matters:

Buyers prefer businesses that aren’t geographically or sector-constrained. This may limit post-sale expansion.

What investors want to see:

- Ability to support clients in multiple industries.

- Regional or remote service flexibility

- Plans for vertical or horizontal scaling.

💡Geography cannot be easily changed, but the verticals an MSP serves can be expanded if local demand exists. Investors look for an MSP with room to grow.

6) ❌They DON’T want to see the majority of revenue tied to a few customers

Potential investors do not want to acquire an MSP that has “too many eggs in one basket” or relies on one or two agreements for the majority of their business revenue. If your business depends heavily on just a few clients, it introduces significant risk: A lost contract could drastically impact cash flow and valuation. Buyers want to see revenue distributed across multiple accounts, with no single customer wielding too much influence. We discuss this and more in “How to differentiate your MSP like a Ninja”.

Why it matters:

High customer concentration means that losing one account could materially impact revenue.

What investors want to see:

- No client contributing more than ~20-25% of total revenue.

- Broad, diversified client base across industries.

💡 While no universal rule exists, buyer interviews confirm that revenue balance is key to perceived stability.

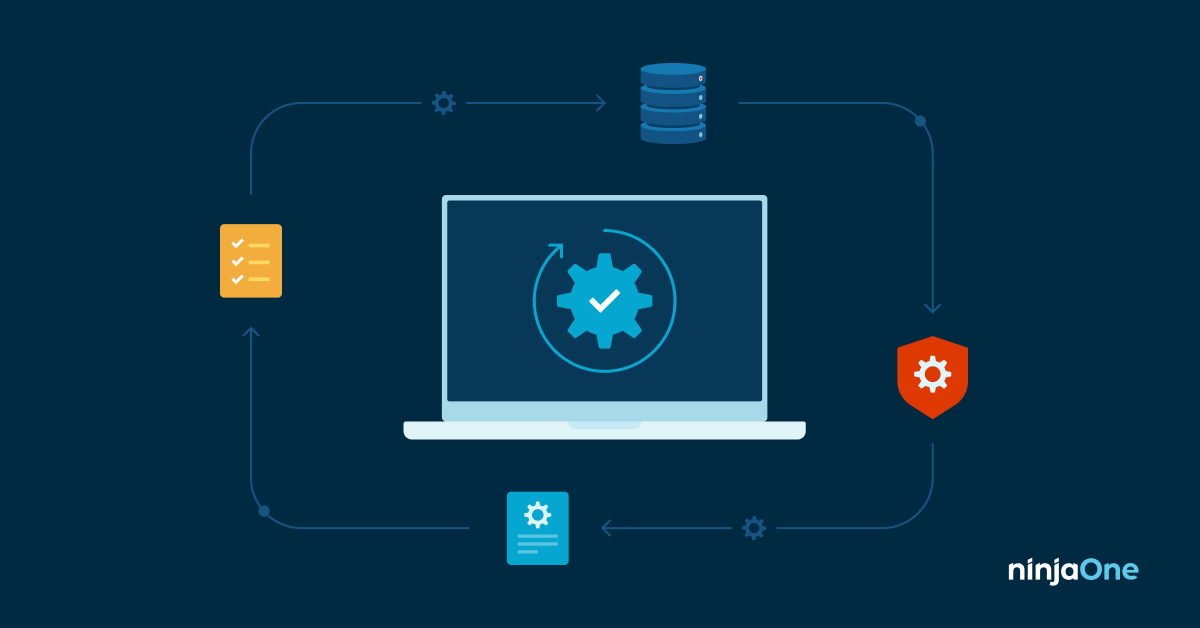

7) ✅ They DO want to see good documentation

The more your MSP embraces current industry standards for documentation and streamlined ticketing systems, the easier it becomes to manage, scale, and transition operations. In 2025, investors expect to see not just organized records but also platforms that support automation, audit trails, and compliance visibility. We recommend checking out “Who Helps the Helpdesk? Using NinjaOne to Maximize Efficiency” for more information.

Why it matters:

Documentation makes operations transferrable, support scalable, and onboarding faster for new techs or owners. It also shows foresight and diligence: MSPs with good documentation are seen as trustworthy and prepared.

What investors want to see:

- SOPs for service, sales, and support.

- Vendor records and licensing logs

- Documented workflows and automation logic

💡 Strong documentation improves efficiency, reduces transition risk, and protects IP.

8) ❌ They DON’T want to see unusual tech stacks

Buyers responsible for managing multiple MSP acquisitions typically prefer streamlined and standardized technology environments over highly customized or fragmented tech stacks. From a valuation perspective, MSPs that use common platforms and avoid niche or homegrown tools are seen as lower-risk investments—particularly in terms of onboarding time and training costs. Adopting mainstream solutions across your client base not only improves operational efficiency but also improves the perceived maturity of your business during due diligence.

Why it matters:

A standardized, interoperable stack simplifies due diligence, onboarding, and long-term management.

What investors want to see:

- Widely adopted automated endpoint management tools.

- Consistent platforms across clients.

The bar is also consistently being raised when it comes to security. MSPs often aren’t expected to have full-blown SOCs. Still, buyers/investors do want to see EDR/MDR and application and access restriction solutions like ThreatLocker and AutoElevate deployed.

9) ❌ They DON’T want to see employees shitposting

A more recent trend in MSP M&A is the prevalence of social media, especially employee posts in the valuation process. A potential investor may do a bit of digging into the MSPs social media presence, employee reviews on sites like Glassdoor, and employee posts mentioning the business on sites like Twitter and LinkedIn. This sort of social media vetting gives a potential investor color to what the owner might claim their company culture is.

Why it matters:

Public employee complaints are culture signals. While you cannot expect all your employees (both past and present) to like you or your company, having multiple negative reviews is a major red flag.

What investors want to see:

- Neutral or positive digital footprint.

- Low Glassdoor volatility and HR risk.

💡 While there are no recent statistics measuring the impact of online reputation on MSP valuation, investors typically review platforms like GlassDoor or LinkedIn to assess employee satisfaction, leadership credibility, and public perception.

10) ✅ They DO want to see owners who are likable and easy to work with

People like to do business with people they trust. This is definitely an intangible but common courtesy, and open communication with a potential investor can go a long way! Investors prefer to work with MSP owners who demonstrate transparency, integrity, and a willingness to collaborate throughout the sales process.

Why it matters:

Good faith, responsiveness, and personality still move deals forward. A poor seller experience can kill otherwise great deals.

What investors want to see:

- Clear and timely communication.

- Realistic expectations around valuation and terms.

💡A seller’s demeanor and responsiveness can directly influence buyer confidence and even impact deal structure and final valuation.

Attract diverse clients by running a streamlined and high-value MSP with NinjaOne.

Plan ahead when looking to boost your valuation

Time is the most precious resource you have when aiming for a higher valuation for your MSP business. Remember that many of these tips for scoring a higher valuation will also make your business operate better, diversify your customer base, and even increase your profitability in the short term. So think of the chase for a higher valuation as a business building exercise and it will make implementation more justifiable today.

Learn MSP valuation and other endpoint management-related topics with NinjaOne

Subscribe to the NinjaOne YouTube channel to stay updated on the latest endpoint management videos, covering topics such as MSP valuation and the importance of a backup strategy.