The Digital Operational Resilience Act (DORA) is a newly enforced EU regulation aimed at enhancing the digital resilience of financial institutions and their third-party service providers. Meanwhile, the General Data Protection Regulation (GDPR) governs how organizations collect, store, process, and protect the personal data of individuals within the EU.

Both regulations aim to strengthen security and protect organizations and individuals in the digital space. Understanding the differences and similarities between DORA and GDPR is crucial for institutions operating in the EU, especially as digital reliance grows, increasing the risk of cyber threats.

This guide will explore DORA vs. GDPR, covering their definitions, purposes, key differences, similarities, and business implications.

What is DORA?

The Digital Operational Resilience Act (DORA) is an EU cybersecurity regulation designed to strengthen the operational resilience of financial institutions (such as banks, investment firms, and insurance companies) and their third-party service providers (including data reporting and cloud service providers).

It recognizes the financial sector’s growing reliance on digital technology and the increasing security risks that come with it. DORA provides a standardized approach that covers five key pillars to ensure consistent ICT resilience practices across the industry:

- ICT risk management – Nurturing the understanding of ICT risks and establishing robust management strategies or frameworks to mitigate cyber risks and ensure business continuity.

- ICT-related incident reporting – Obligations to report ICT incidents to regulators within a defined timeframe.

- Digital operational resilience testing – Regular testing of IT systems to assess resilience and identify vulnerabilities, including penetration testing, red teaming, and other security evaluations.

- ICT third-party risk management – Vigilant oversight of third-party service providers, including clear contract terms on risk management and security standards.

- Information and intelligence sharing – Sharing of cybersecurity threat intelligence to enhance collective resilience across the industry.

DORA compliance requirements and deadlines

Since DORA is a mandatory regulation for all financial institutions and their third-party service providers in the EU, non-compliance can result in fines and reputational damage. DORA was fully implemented on January 17, 2025, meaning organizations must now adhere to its standards. Here are the key compliance requirements and deadlines to keep in mind:

- ICT risk management

- Third-party oversight

- Incident reporting

- Governance

- System documentation

- Contracts with providers

- Concentration risks

- Monitoring

- Employee training

- Continuous improvement

By April 30, 2025, financial institutions must submit their Register of Information, including documentation of ICT providers, critical functions, and subcontracting arrangements. Moving forward, quarterly and annual reporting on ongoing ICT incidents, resilience metrics, and testing evaluations throughout the year will be required.

What is GDPR?

The General Data Protection Regulation (GDPR) is an EU law that governs the collection, processing, and protection of personal data for all individuals under the European Union. It is widely regarded as the world’s strictest privacy and security law, imposing obligations on any company worldwide that processes the personal data of EU citizens, regardless of their location. This regulation grants EU citizens greater control over their personal data and how organizations use it.

Let’s take a look at GDPR’s seven core principles:

- Lawfulness, fairness, and transparency – Collection and processing of personal data must be done lawfully, fairly, and openly to the data subject.

- Purpose limitation – Data collection must be conducted only for specified, legitimate purposes, which must be clearly communicated to the data subject upon collection.

- Data minimization – Only the minimum necessary data should be collected to fulfill the specified purposes.

- Accuracy – Data must be kept accurate and up-to-date.

- Storage limitation – Data should only be stored if necessary, and organizations must delete it once it is no longer needed.

- Integrity and confidentiality – Organizations must process data securely, ensuring its integrity and confidentiality while protecting it from breaches and unauthorized access.

- Accountability – Organizations must demonstrate GDPR compliance by adhering to these principles.

GDPR compliance requirements and penalties

GDPR compliance extends beyond simply meeting listed requirements, it involves demonstrating the policies and procedures organizations have in place to uphold its core principles. Here’s a detailed breakdown of GDPR compliance requirements:

- Lawful basis and transparency – Organizations must keep an updated record of data processing activities, access details, and protection measures, including retention policies. For high-risk processing, GDPR requires a Data Protection Impact Assessment (DPIA), ideally conducted during project planning. While not always mandatory, it demonstrates GDPR compliance. If a Data Protection Officer (DPO) is employed, they must be consulted to ensure legal compliance.

- Data security – Organizations must implement technical and organizational measures to protect data, such as encryption and anonymization. They must also train staff on data handling procedures and keep records of this training. Plus, organizations must have a clear protocol for responding to data breaches that expose personal data and must report breaches within 72 hours.

- Accountability and governance – Organizations must appoint a GDPR compliance lead responsible for overseeing implementation and serving as the main point of contact. This person should be an expert in GDPR, data protection laws, and their enforcement. A Data Protection Officer (DPO) is generally recommended for this role.

- Privacy rights – Organizations must ensure that data subjects understand their rights regarding data privacy. This includes requesting copies of their personal data and invoking their ‘right to be forgotten,’ which allows them to request permanent data deletion. Organizations must ensure that these requests are acted upon and must be transparent about these processes.

- Concept of consent – Organizations must implement a consent system that allows data subjects to explicitly agree before data is collected. Pre-selected opt-in boxes are not allowed. Consent options must be provided separately from the terms and conditions and in different ways. Moreover, organizations must maintain records of obtained consent.

It is important to keep in mind that non-compliance with GDPR can lead to severe financial penalties of up to €20 million or 4% of annual global revenue (whichever is higher).

ALSO READ: Why NinjaOne Protects Customer Privacy To Be GDPR Compliant

DORA vs. GDPR: Key differences

DORA and GDPR share a common goal of ensuring data security and protection for data subjects. However, they have distinct perspectives that are crucial to understand. Here are the key differences between DORA and GDPR:

DORA scope vs. GDPR scope

DORA focuses on ICT operational resilience, providing a harmonized framework for financial institutions and their third-party providers to safeguard against cybersecurity and ICT risks that could disrupt operations.

On the other hand, GDPR centers on data privacy and protection, regulating the collection, processing, storage, and sharing of personal data for individuals in the EU. GDPR prioritizes user rights, aiming to prevent data misuse and ensure transparent data handling practices.

DORA focus vs. GDPR focus

What sets DORA apart from GDPR is its strong focus on cybersecurity risk management. DORA recognizes financial institutions’ increasing reliance on digital technology, as well as the growing risks. Its goal is to ensure secure digital operations and resilience against cyber threats.

Whereas, GDPR prioritizes personal data privacy, giving users more control over their personal information, regardless of the company or industry they interact with worldwide.

DORA applicable entities vs. GDPR applicable entities

DORA applies to financial institutions such as banks, insurance companies, investment firms, credit institutions, crypto-asset service providers, and payment processors, as well as ICT third-party service providers, including cloud service providers, data centers, and software vendors within the EU.

Meanwhile, GDPR applies to any organization worldwide that processes the personal data of EU citizens, regardless of its location.

DORA compliance vs. GDPR compliance

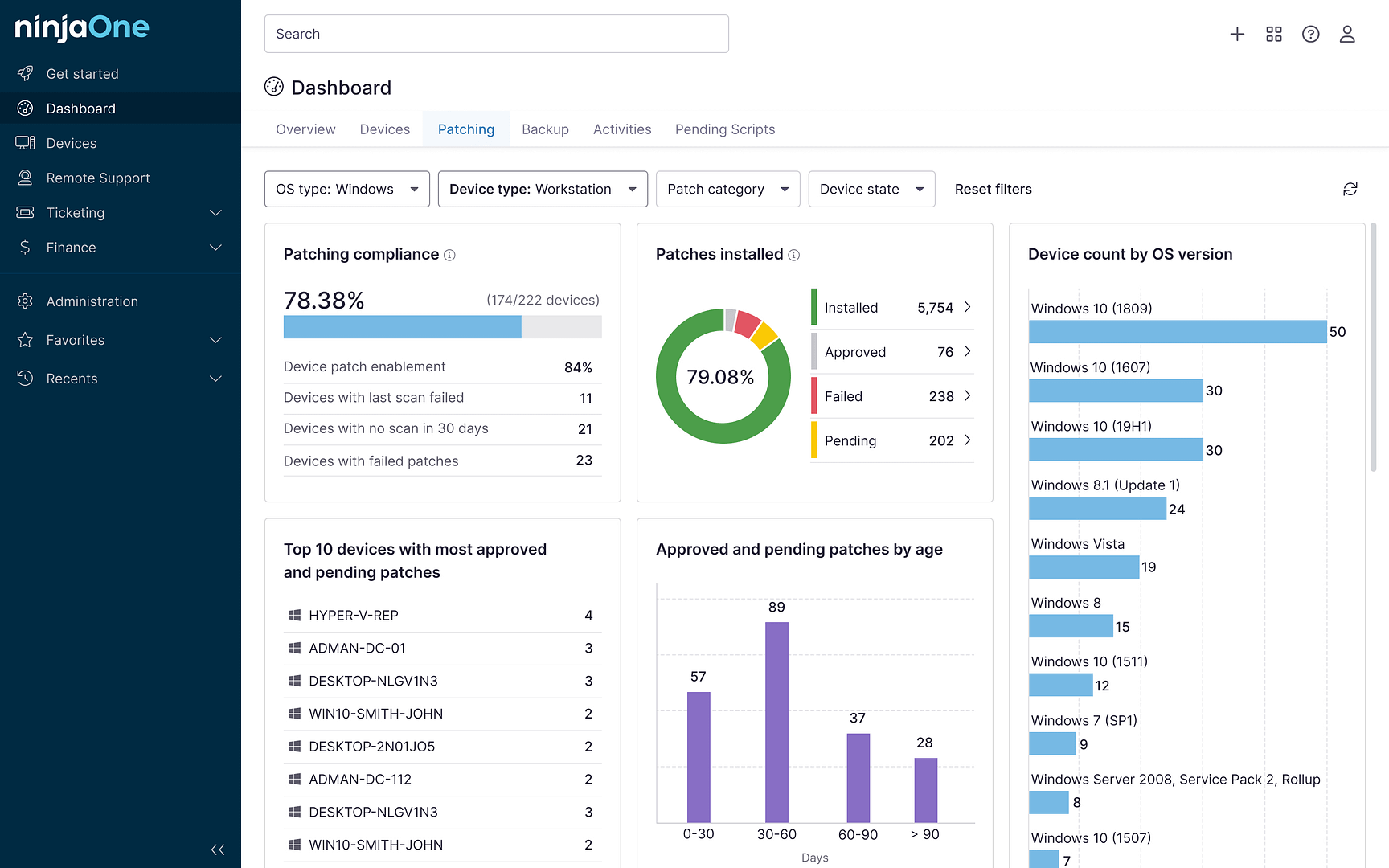

DORA compliance focuses on implementing robust ICT risk management frameworks, which include continuous monitoring, cybersecurity testing, incident reporting, and ensuring third-party providers meet security standards.

Meanwhile, GDPR compliance covers broader data protection measures, including managing personal data. It requires organizations to demonstrate how they provide data access and portability, secure storage and encryption, data deletion requests, and breach notifications.

DORA regulatory enforcement vs. GDPR regulatory enforcement

DORA is supervised and enforced by financial regulatory authorities which include the European Banking Authority (EBA), the European Insurance and Occupational Pensions Authority (EIOPA), the European Securities and Markets Authority (ESMA), and national financial regulators.

GDPR is enforced by data protection authorities, such as the European Data Protection Board (EDPB), national data protection agencies in each EU member state, and supervisory authorities.

Similarities between DORA and GDPR

While DORA and GDPR come from different perspectives, they share aspects that make them complementary with one another. Some of the major similarities between DORA and GDPR include:

Risk management and incident reporting

Both DORA and GDPR were established to address the increasing risks in the expanding digital space. These regulations mandate strong risk management frameworks for entities within their scope.

Moreover, both require incident reporting within strict deadlines to ensure continuous risk management improvement. DORA mandates reporting cybersecurity incidents to regulators within set timeframes, while GDPR requires organizations to report data breaches within 72 hours.

Strict compliance requirements and penalties

There are huge differences between DORA and GDPR compliance requirements. However, both enforce strict compliance standards. DORA mandates resilience testing, security frameworks, and compliance audits, while GDPR focuses on data privacy policies, encryption, consent, and data handling management.

Both regulations also impose serious penalties. DORA includes severe fines, business restrictions, and legal consequences, while GDPR imposes fines of up to €20 million or 4% of global revenue, along with potential reputational damage for violations.

Protect consumers and businesses from cyber threats

Above all, DORA and GDPR share the same goal of protecting consumers and businesses from cyber threats. Both regulations provide standardized guidelines to help institutions protect themselves and their consumers while relying on digital technology for daily operations, as technology continues to evolve and grow more complex.

Implications for businesses

DORA and GDPR are complex regulations with a significant impact on businesses. Non-compliance can lead to severe penalties, damaging a company’s reputation, integrity, and reliability. However, compliance helps create a secure environment for institutions, their staff, and consumers, ensuring trust and resilience.

How to prepare for DORA and GDPR compliance

Organizations must understand the core principles of both regulations and develop comprehensive frameworks to uphold them to the highest standards.

For DORA, financial institutions must establish ICT risk management frameworks, resilience testing, and incident response plans, and ensure that third-party providers comply with DORA’s security requirements.

For GDPR, organizations must implement data protection plans, consent management, and data processing policies, and enforce strong encryption and access controls to safeguard personal data.

Overlapping compliance requirements for DORA and GDPR

Since both regulations share a common objective, there are overlapping requirements that can benefit institutions required to comply with both. DORA and GDPR are stringent in incident reporting, risk assessments, and continuous monitoring. Organizations must align their security, compliance, and privacy policies to ensure a unified approach to data protection and cybersecurity.

Moreover, financial institutions covered under DORA are also subject to GDPR. Those handling both financial and personal data must integrate DORA’s cybersecurity measures alongside GDPR’s data protection principles.

The role of IT security, legal teams, and compliance officers in ensuring adherence

IT security teams are responsible for monitoring, preventing, and responding to cyber threats, as well as implementing data security measures to maintain a secure digital environment. They work closely with legal and compliance teams, who ensure that all regulatory requirements under DORA and GDPR are fully met.

Digital Operational Resilience Act vs. General Data Protection Regulation: Wrapping Up

The European Union is committed to combating cybersecurity risks, with DORA and GDPR serving as major steps toward securing the digital financial sector. DORA helps the financial sector manage digital complexities and operational risks, ensuring resilience in daily operations. Meanwhile, GDPR focuses on protecting data subjects, creating a safe digital environment where EU citizens’ data is protected, and they have control over their personal information.

For businesses navigating both regulations, adopting an integrated approach that aligns ICT risk management with data protection principles can greatly support compliance efforts. Cross-functional collaboration between IT security, legal, and compliance teams must also be strictly observed to ensure full adherence to DORA and GDPR.

For further details, refer to the resources below.

- What is the Digital Operational Resilience Act (DORA)?

- What is GDPR, the EU’s new data protection law?

- Synergies between DORA and GDPR: A comprehensive approach to data security

Frequently Asked Questions (FAQs)

-

How does DORA affect financial institutions?

DORA mandates stricter cybersecurity measures and ICT risk management for financial institutions and their third-party service providers. It specifically aims to prevent cyber threats and operational failures within the financial sector.

-

Does GDPR apply to cybersecurity?

Yes, GDPR has strong cybersecurity requirements related to data protection, encryption, and breach notification. Its primary focus on data privacy necessitates the integration of cybersecurity best practices.

-

What businesses need to comply with DORA?

DORA applies to all financial institutions within the EU, as well as their third-party service providers that support the financial sector.