Key Points

- Understand the DORA Regulation: The Digital Operational Resilience Act (DORA)—effective January 17, 2025—enforces EU-wide cybersecurity standards for financial institutions and critical ICT third-party providers.

- Who Must Comply: DORA applies to banks, credit/payment institutions, insurers, investment firms, crypto-asset service providers, financial market infrastructures, audit/data analytics firms, and ICT vendors operating in the EU.

- DORA Compliance Checklist:

- Conduct Compliance Gap Analysis: Assess current digital infrastructure, identify gaps, and set project plans with deadlines.

- Implement ICT Risk Management: Identify vulnerabilities, create contingency plans, and continuously monitor critical systems.

- Establish ICT Incident Reporting: Follow EU reporting protocols—notify within 4 hours, update within 72 hours, and finalize within 1 month.

- Apply Third-Party Risk Management: Secure contracts, audit vendors, and enforce DORA Article 30 clauses (e.g., audit rights, exit strategies).

- Promote Information Sharing: Join EU cyber threat intelligence networks (ENISA, FS-ISAC) for collaboration and early threat detection.

- Test Digital Resilience: Run annual ICT testing programs, including TLPT every 3 years for critical systems.

- Five Pillars of DORA Compliance: These are ICT risk management, incident reporting, resilience testing, third-party risk management, and information sharing.

- Consequences of Non-Compliance: Penalties include fines, inspections, public notices, forced activity cessation, and expensive remediation processes.

- Best Practices for Ongoing Compliance: Conduct regular staff and vendor training on cybersecurity, use automation and AI tools for policy enforcement and endpoint management, and maintain DORA-compliant documentation, audits, and yearly reviews.

The Digital Operational Resilience Act (DORA) sets the digital protection standard for financial institutions operating in the European Union (EU), which involves critical third-party service providers and overseas authorities. This law enforces strict rules to get ahead of modern cyber threats targeting the finance sector, and following this DORA compliance checklist simplifies the compliance journey.

This article outlines the full DORA compliance checklist, key components, and the concrete steps you need to take.

This article outlines the full DORA compliance checklist for financial institutions in the EU, including the regulation’s pillars or key components, and the concrete steps you need to take to simplify your organization’s compliance journey.

What is DORA?

The Digital Operational Resilience Act (DORA)—applied across the European Union (EU) since January 17, 2025—sets harmonized rules for financial institutions and establishes an EU oversight framework for critical ICT third-party providers (CTTPs) led by the European Supervisory Authorities (ESAs). In essence, this regulation enforces strict rules to get ahead of modern cyber threats targeting the EU’s finance sector.

Who does DORA apply to?

The scope of DORA compliance requirements covers financial institutions who do business in member states of the EU, including but not limited to the following:

- Banks

- Credit and payment institutions

- Insurance companies

- Investment firms

- Crypto-asset and crowdfunding service providers

- Data analytics and audit services

- Financial market infrastructures

Improve your security posture with autonomous IT management.

→ Discover how to scale Enterprise IT Security with NinjaOne

DORA compliance checklist

Before we get started, it’s important to review DORA’s full legislation with your legal team to check if it applies to your organization. Here’s how financial institutions within the EU and critical service providers can ensure total compliance with DORA cybersecurity requirements.

1. Conduct a Compliance Gap Analysis

- Conduct an initial review: Do a complete review of DORA’s needs and determine your project size and budget for adoption.

- Identify what’s missing: Compare your current digital infrastructure with DORA’s requirements.

- Rank them based on importance: Strategically prioritize the largest “gaps” in your infrastructure.

- Create project plan: Outline potential subprojects and milestones.

- Work on a deadline: Create time-sensitive action plans to “patch the holes” within your framework to get as close as possible to DORA standards.

2. Perform ICT Risk Management

- Spot the risks: Identify the weakest spots of your infrastructure and document the process.

- Prepare contingencies: Plan how you’ll approach certain incidents, assign responsibilities, and have business continuity procedures ready to go in case your system comes under attack.

- Monitor critical systems: Have eyes on the most important parts of your ICT infrastructure 24/7 to detect/address threats early.

Assess your system’s vulnerabilities including potential risks and prepare a vigorous response plan. Disaster risk management is at the very core of DORA, and its main pillars revolve around it.

3. Report ICT incident reporting

- Identify, escalate, and report: Follow DORA-specific protocols when designing workflows for incident reports and addressing priority.

- Set a timeline: All reports need to be documented, sent, and swiftly escalated to a competent authority designated by the state in the EU.

- Design workflows to meet DORA’s timelines for major ICT-related incidents: This necessitates initial notification within 4 hours of classification and no later than 24 hours after detection, an intermediate report within 72 hours, and a final report within 1 month. Additionally, notify your national competent authority using the EU templates.

Banks and insurance companies are legally obliged to disclose incidents when they occur in the EU and beyond. As such, third-party ICT companies are almost always involved to speed the process along, and since they are significantly tied to key infrastructure, DORA must also account for these companies.

4. Apply Third-Party Risk Management

- Assess providers for potential risks: Financial institutions must monitor subpar ICT subcontracting deals that can put them in harm’s way.

- Secure tight contracts: Legally binding agreements add a considerable incentive to stick to security and compliance expectations.

- Keep tabs on third-party vendors: Track and monitor each provider’s access to your ICT systems.

- Ensure DORA Article 30 contract clauses: These include audit/access rights, data-processing locations, incident notification/handling, sub-contracting conditions, termination and exit support, and exit/transition plans.

A good track record is essential when choosing a business partner, and the same rings true for third-party vendors under EU investment companies. This can be further tested via training programs to ensure that everyone is on the same page.

5. Practice Information Sharing & Collaboration

- Keep an eye on new threats: Join cyber threat intelligence forums and learn from other industries to prepare your organization for protection against new malware.

- Speak on secure lines: Create internal methods of communication and reporting.

- Follow the EU standard: EU regulatory bodies all have cybersecurity standards that payment institutions need to align with. These include the European Union Agency for Network and Information Security (ENISA), which provides expert support to enhance EU cybersecurity and resilience.

- Participate in trusted communities: These include the Financial Services Information Sharing and Analysis Center (FS-ISAC), encouraging voluntary cyber-threat intelligence sharing while respecting confidentiality, GDPR, and competition law.

DORA supports knowledge-sharing on emerging cyber threats across the board to improve the EU’s digital resilience in finance.

6. Test for Digital Operational Resilience

- Maintain a risk-based annual testing program for ICT systems: If you meet the criteria, run threat-led penetration testing (TLPT) at least every 3 years on live production for critical functions

- Do security simulations: Threat-led penetration testing (TLPT) simulates real-world cyber attacks to test your defenses.

- Learn from your findings: Review your findings and use them to continuously refine defensive measures and cover your weak spots.

Testing your defenses with simulations of real-life attacks is the best way to measure your organization’s cybersecurity. DORA ICT risk management requires EU financial companies to regularly check their infrastructure for weak points and design new ways to shield client data.

DORA’s key components

Ever wonder how large banks stay safe? Distributed online databases and centralized electronic databases are used as modern-day vaults, and financial institutions follow regulations like DORA to keep their security airtight, safeguarding their clients’ accounts.

The five pillars of DORA compliance

- ICT Risk Management

- ICT Incident Reporting

- Digital Operational Resilience Testing

- Third-Party Risk Management

- Information Sharing

DORA’s main pillars create a solid framework to keep financial institutions safe. It’s like an instruction manual for digital safety that keeps important businesses like banks and insurance companies bulletproof.

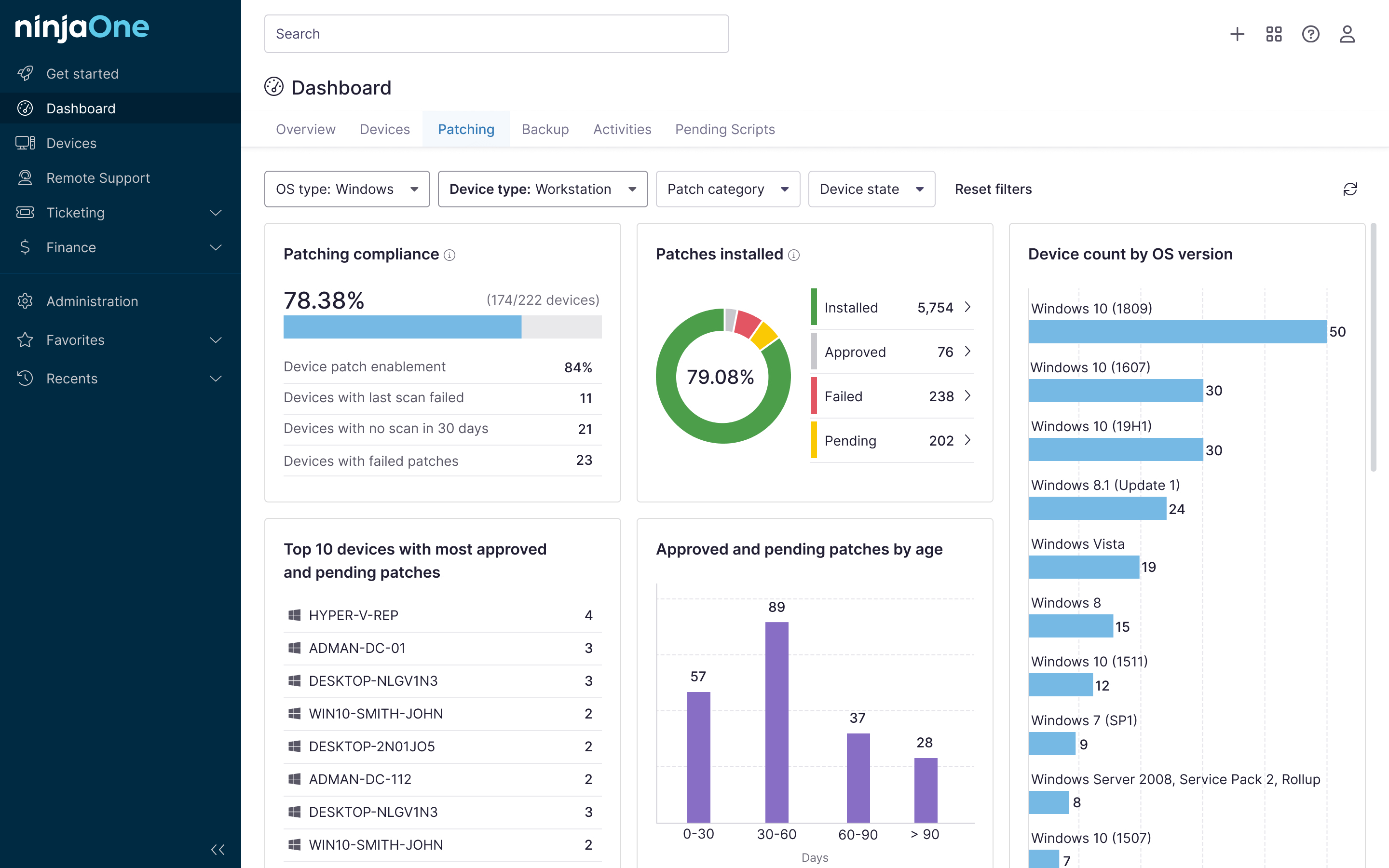

Automating certain policy and endpoint management aspects facilitates the process and gets your organization one step closer to total DORA risk management.

See how the concepts come together in this video: ‘Maximizing Microsoft Cybersecurity Solutions for DORA Compliance’.

Why financial institutions must comply with DORA regulations

Not following DORA regulations has major consequences for financial institutions operating in the EU. DORA empowers each member state to enforce their own penalties, which may include:

- Large fines

- Inspections and corrective measures

- Public notices

- Cessation of activities

- An expensive remediation process

In the case of financial entities, aligning with DORA is essential for continued business in the EU, especially since the framework builds on the biggest EU compliance regulations. For example, it follows the lead of ISO 27001 and expands on it with specific measures like third-party management and incident response protocols while complementing the Network and Information Security 2 Directive (NIS2) – a directive for system security – through robust cyber threat mitigation. Most importantly, DORA also supports GDPR’s emphasis on overall data privacy while keeping an eye on evolving threats.

Looking for ways to consistently meet strict regulatory standards?

Best practices for maintaining DORA compliance

- Run a tight ship and get everyone on the same page. Continuously hold training seminars for your staff as well as third-party contractors to update your workforce with the current legal standards in cybersecurity.

- Emerging technology can eliminate tedious tasks with the push of a button. To work better and faster, familiarize everyone with the latest tools used to automate security protocols, such as all-in-one RMM software and the very best AI tools.

- Finally, enforce DORA-compliant documentation standards across all levels and conduct yearly audits and compliance reviews. You need to stay among the best in the industry, and this is how you prove it to the competition.

Elevate your cybersecurity standards with a DORA compliance checklist for financial institutions

To meet DORA compliance requirements, find and address weak points. You must report incidents in a timely manner to the authorities, and simulate real-life attacks on your system to test the limits of your cybersecurity. You should also evaluate third-party vendors as well as participate in worldwide cyber threat intelligence exchanges to stay vigilant against new and emerging threats.

Adopting this framework keeps banks and insurance companies proactive towards their cybersecurity, lessening the chances of vulnerability and strengthening trust with stakeholders. Not only does it align with international regulations, but it also positions your organization as a leader in cybersecurity, attracting more customers to do business with you.